Are we at the market peak?

Happy 2020! To kick off the new year, we’ve got a long one for you. It’s a 5 minute read, but if you do stick with it, we’re confident it will give you at least a few things to think about, which should put your portfolio in better shape.

2019 was an incredible year for investing, almost every key index/asset class paid out significant returns. To give you a sense of some of the returns investors experienced in 2019, the S&P 500 returned 30%, the MSCI Emerging Markets index did 12%, FTSE ST REIT index has done nearly 25%, the JPM EM Bond Index returned 16%, the Bloomberg Barclays US Agg index gave 9%, and Gold increased 19%. The only wrong way to have gone in 2019 was to have stayed on the side-lines. However with such a run-up (after a near-decade-long -multi-asset bull market) the question becomes – are we at the market peak?

If you’ve been following Ray Dalio, the answer is yes. According to him, the future doesn’t look all that pretty, and as (per his words) we are late in the market cycle, and rates are near lows, central banks won’t be able to avoid a downturn. Now, we here at Farrer Wealth, have a lot of respect for Dalio, but are very cautious about making any sort of broad macro or economic predictions. Even if Dalio is right, we don’t know when his prediction will come true. It could be in 2020, 2021 or in 2035 for that matter. There is no rule that says the market has to see a recession in any given period.

That said, valuations are stretched. The current Schiller PE Ratio (a way to adjust earnings ratios for business cyclicality) is around 30x for the S&P 500. To put this in perspective the historical average is 16.68x[1]. On the fixed income side, there are now $15 trillion worth of bonds[2] which are priced at a negative yield. This is roughly 13-15% of the total bond market.[3] If you remember from your Investment 101 classes you know that as yields/interest rates fall, bond prices increase. So you can imagine that a negative interest rate environment (one which we haven’t seen before) will result in some very expensive debt.

Thus, markets are at all-time highs, we’ve had a record number of bull years, valuation are stretched, but there is no telling when a recession (if any) hits. So, how do we know where we are in the cycle?

At times like these, when we’re unclear on the path forward, we like to pull up a framework used by Howard Marks, and presented in his book, “Mastering the Market Cycle”. Marks describes market sentiment as a ‘pendulum’ that swings from very optimistic to very pessimistic. When the market is very optimistic, you should be very cautious and when the market is very pessimistic, you should be very aggressive. We really like this framework as it doesn’t force us to make future predictions (which we are no good at anyway) but rather, allows us to reflect on the present and gauge if we are at market peaks or lows. To figure out which scenario we are in (or if we are somewhere in between) he presents a framework shown below, which we’ve summarized a bit.

The goal of the exercise is to think through each sub-section and make a selection as to which scenario you think the world is in (we focus on public markets but you could do this for private markets too). After you’re done, if your answers are overwhelmingly on one side or the other, it can be a strong signal of what path to take going forward. Just in case it wasn’t clear, as Marks says in his book “if you find that most of your checkmarks are in the left-hand column, hold on to your wallet.”

Below, we are going to give you our thinking behind each selection, but if you disagree, feel free to do the exercise yourself and come to your own conclusions, as some of the selection process can be subjective.

Our Results:

Economy: This is probably the sub-section that is up for most debate, as economies around the world are going through different cycles. For example, the US inflation is under control, unemployment is the lowest since 1969[4] and the trade war seems to be easing. However in China, a GDP growth rate of 6.2% is the lowest in 27 years[5] and India is seeing growth rates of 4.5% in Q2 2019-20 (down from 7.1% a year ago)[6]. The Eurozone continues to grow at a tepid 0.2% (versus an average of 0.39% over the last ~25 years[7]). That said, while you could argue that a slow-down is alarming, all major economics are still growing. Thus we would chalk the global economy as somewhere between ‘vibrant’ and ‘sluggish. Do note that a clear and final resolution of the trade-war could push the global economy back to “vibrant” quite quickly.

Outlook: We would say that the outlook is ‘positive’ namely due to two things – 1) Global Equity market at/or reaching all-time highs and 2) A truce called in the trade war. Based on these two items, and anecdotal conversations we’ve had with other investors, we feel people believe 2020 should be a positive year for asset growth (although returns are predicted to be in the low single digits).

Lenders: Lenders are very ‘eager’ to lend. We’ve seen this across the board with the compression in spreads between High-Yield, Developed Markets, and EM debt[8]. The explosion of online (P2P) lending platforms and NBFCs has also expanded debt markets.

Capital Markets & Capital: September 2019 was the busiest year ever for corporate debt issuance. Companies around the world sold a record amount of bonds last month, taking advantage of low borrowing costs fuelled by investors’ frenzied search for yield. Also, as stated above, close to $15tn worth of debt globally carried a negative yield at the end of September[9]. We are going to mark these categories as “loose” and “plentiful” respectively.

Terms: We’ve been seeing this for the last few years, but according to Moodys the hunger for yield has “paved the way for unprecedented erosion in capital structures and credit quality.[10]” Further in Europe for example, we’re seeing the rise of covenant-light loans which exclude terms that would force borrowers to maintain key financial indicators such as leverage ratios within set limits[11]. Examples like this, as well as our observations of high-yield new issuances lead us to believe that credit terms are more ‘easy’ than not.

Yield-Spreads: This one is easy, based on the data discussed in previous points, its hard to argue yield spread are not ‘narrow’.

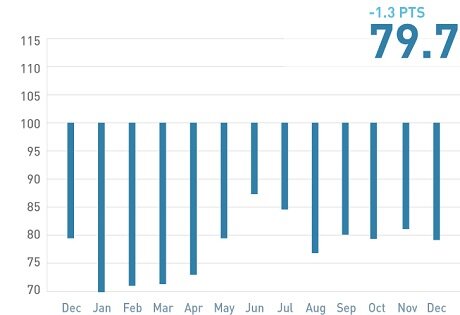

Investors: This is a tough one as you’d think with many markets at all-time highs, or having excellent 2019, investors would be jubilant. But State Street’s Investor Confidence index shows that for much of 2019, Investors have been a bit risk-averse[12]. December showed a drop in confidence from November, which was already lower than the June high of 87% (100% is Neutral). Thus it seems that the huge market rally in 2019 hasn’t lifted investor sentiments. Further as the bull market continues to stretch, it seems that investors are unclear on how much longer it can last, and when the next recession will come. Considering that the Index has shown investor sentiment to be continually below 100, we have to mark this section as ‘bearish’ (we would prefer the word “cautious” but who are we to change Marks’ language).

Moving on, we tackle the question of if investors are sanguine or distressed? Survey data from the AAII Investor survey shows that investors are in a ‘neutral’ position with short term sentiment showing a relatively equal split between bullish/neutral/bearish.[13] So we’re somewhere in between sanguine and distressed here.

Next question – are investors buying hand over fist or holding back? Data out of the US showed that investor cash holdings were 18% higher in October 2019 then they were at the start of the year,[14] despite a decline in short-term rates. Another survey by UBS wealth management showed that 55% of wealthy investors are expecting ‘a significant’ drop in stocks before the end of 2020[15]. Thus the data is pointing us toward choosing “uninterested in buying” to sum up the Investor portion of this exercise.

Asset Owners: Data from EPFR shows that both bond and equity funds have cumulatively seen a net positive flow. However it’s clear from the graph below[16] that a lot of money has moved from equity funds to money-market funds, as equity investors get a big jittery (some of this money also went into equity ETFs which had their biggest inflow year ever[17]). That said, on net basis we did see that on the whole Investors are either buying or holding rather than selling in droves.

Sellers: Given that we’ve stated in the above point that asset owners are happy to hold, it would be inconsistent if we said that sellers are ‘many’, thus by default here we select ‘Few’.

Funds: Across the board we’ve gone ‘pessimistic’ on the fund sub-section because of what we’ve seen over the last year. 2010-2019 was not a good decade for fund performance. Broad under-performance, a fall-from-grace for many major funds/fund managers (Neil Woodford, Mark Barnett, Louis Bacon), more funds closing than opening (a trend continuing since 2016),[18] and investors yanking $81.5 billion through November 2019 from funds all show the difficulty faced by active managers. Anecdotally, we’ve also seen a huge change in the 2% + 20% model that was popular in the 2000s. Only the very best funds can still command this, and with the onslaught of investors moving into passive investing, investors seem to have the upper hand when it comes to fund-terms.

Recent Performance: As the data in this first portion of this post shows, markets have had a tremendous year in 2019, and it is clear that recent performance is ‘strong.’

Prospective Returns: With stock markets surging, and bond markets pricing in very low interest rates, most banks and investment houses are predicting a subdued 2020 versus 2019. According to data compiled by Fox Businesses, surveys of 11 wall-street banks shows predictions of just a 2.1% gain in the S&P 500 in 2020.[19] Further, this Bloomberg compilation of wall-street research analysts points towards ‘low’ prospective returns across asset classes.[20]

Risks: Overall based on the investor sentiment and valuations, it seems like Risk is high. And the key risks at this point would be “buying too much” rather than “buying too little” and “taking too much risk” rather than “taking too little” given what potential returns we might see in 2020. We will admit this section is quite qualitative in nature, so if you have another view, it might change your overall conclusion.

Ok! Now that we’ve taken a look at each category and marked down our opinion on the current situation, it’s time to look at the board as a whole. While most of our selections are on the left, it’s not overwhelmingly so biased. It appears that the weakness in funds and investor sentiment is keeping the board somewhat balanced.

Now, dear reader, you will ask – what does this mean? We believe that this means that while the market is not at its peak, it is somewhere close to it. If however, investor sentiment gets a bit better, and flows start moving into funds rather than out of them, we might move some of the right-hand circles to the left-hand (as we write this we’re reading reports on investor sentiment globally improving as China pumps liquidity into its markets[21]). Further, if the trade war has a final resolution, we could see the global economy roar again.

So what do we do now? Again, our advice is best told by repeating what Howard Marks told us when we met him in person. “Move forward, but with caution” and “Prepare your portfolio for its worst day”. This means that while markets are not at their peak, they are getting close to it, so when buying make sure you are buying with a margin of safety. Also take a look at your portfolio and do what’s called a “pre-mortem.” Imagine everything has gone wrong and you’ve lost a huge chunk (60-70%) of your net-worth, then ask yourself, what do you think could have caused it? If you think there is even a remote possibility of this scenario occurring, start to unwind/sell the positions that are most likely to be affected when it does happen. Do note, if you think to yourself “yeah it could happen, but the odds are so low” – read the book “When Genius Failed.”

Thanks for sticking with us in this long post! We hope you found it useful and makes you actively think about your portfolio in 2020.

Happy investing all!

[1] https://www.multpl.com/shiller-pe

[2] https://www.bloomberg.com/graphics/2019-negative-yield-debt/

[3] https://www.sifma.org/wp-content/uploads/2017/08/US-Fact-Book-2018-SIFMA.pdf

[4] https://www.npr.org/2018/10/05/654417887/u-s-unemployment-rate-drops-to-3-7-percent-lowest-in-nearly-50-years

[5] https://www.dw.com/en/chinas-gdp-growth-slows-to-27-year-low/a-50881319

[6] https://edition.cnn.com/2019/11/29/economy/india-gdp/index.html

[7] https://tradingeconomics.com/euro-area/gdp-growth

[8] https://www.imf.org/~/media/Files/Publications/GFSR/2019/April/English/ch1.ashx?la=en

[9] https://www.ft.com/content/eef8234c-e3c0-11e9-b112-9624ec9edc59

[10] https://www.ft.com/content/7b0df4bc-fefe-11e9-b7bc-f3fa4e77dd47

[11] https://www.ft.com/content/f03943c2-04f9-11e9-99df-6183d3002ee1

[12] https://newsroom.statestreet.com/press-release/investor-confidence-declined-july-24-points-849

[13] https://www.forbes.com/sites/investor/2019/12/05/investor-sentiment-of-neutral-hits-two-month-high/#6802a0c545d2

[14] marketwatch.com/story/investors-are-pivoting-to-cash-thats-not-a-good-sign-2019-10-08

[15] https://www.marketwatch.com/story/about-55-of-wealthy-investors-are-bracing-for-a-significant-drop-before-the-end-of-2020-ubs-survey-shows-2019-11-12

[16] https://www.marketwatch.com/story/equity-fund-flows-show-retail-investors-fear-of-missing-out-amid-record-setting-rally-analysts-say-2019-12-27

[17] https://finance.yahoo.com/news/2019-326b-etf-inflows-2nd-050000019.html

[18] https://www.bloomberg.com/news/articles/2019-12-30/hedge-fund-purge-deepens-as-3-trillion-market-retrenches

[19] https://www.foxbusiness.com/markets/stock-market-wall-street-predictions-2020

[20] https://www.bloomberg.com/graphics/2020-investment-outlooks/

[21] Also as we write this, the US assassination of and Iranian official could very quickly sour sentiment too