The EVOlution of a Thesis

Dear Readers, we will often make the disclosure when we talk about a publicly listed company that our discussion is not meant to be construed as investment advice. We must emphasise this warning for this piece as not only are we discussing a publicly listed company, but we are discussing one we own and have been very publicly bullish about. Please do your own diligence.

Evolution (“EVO”) is the market leader in Live Casino, supplying online gambling services to online casinos globally with a suite of award-winning and fan-favourite games such as Crazy Time, Infinite Blackjack, and Deal or No Deal Live. We’ve written about Evolution previously (click here to read) so we won’t go into too much detail about the company. However, it’s important to note that the company is the name in the space. It has over a 60% market share, near 70% EBITDA margins, growing at nearly ~100% (~50% organically) and is known in the industry for being the most innovative player when it comes to their games.

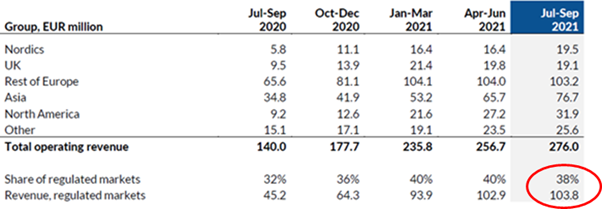

On the surface, this looks like a stellar company, and till date, it really has been. Since 2012, the company has increased its revenues 30x, its EBITDA 60x, and its stock price has increased 70x since listing. However, the biggest bear case has been that EVO secures most of its revenues via un-regulated markets.

Now, according to the company, unregulated does not mean illegal, it simply means markets which have not legalized, nor made illegal, the act of gambling online. A large chunk of this unregulated revenue comes from Asia, LATAM, and certain parts of Europe.

News hit last week that a ‘competitor’ of Evolution had complained to the New Jersey Division of Gaming Enforcement (NJDGE) that not only was Evolution deriving revenues from countries where gambling online is illegal, but worse, was deriving revenues from countries that are on American sanction lists (like Iran). The filed report seems to have been leaked and can be read here.

When news of this report became public, EVO bulls were quick to dismiss it as a hit piece. As bulls ourselves, we were inclined to agree as a lot of the report seemed ‘fishy’. It was filed by an unnamed ‘competitor’, it used dubious practices, and it seemed to get a few things fundamentally wrong about EVOs business models. However, we have learned the hard way to never dismiss anything out-of-hand no matter how distasteful or disagreeable we might find it. So, we decided to dive in. Below, we discuss our take. We will defend the company in some places, but openly admit problems in others. But do rest assured, that we take no pleasure in the latter (remember we are bulls) and we are writing this piece to a) help us think through the situation and b) be transparent about our process with our clients.

The “hit” piece:

As mentioned above, the report’s two most severe accusations are that EVO does generate revenue from a) sanctioned countries and b) countries where gambling online is illegal. Do note this distinction is an important one as “a)” is significantly worse than “b)” although neither is good. The other part of the report that’s worth noting is that it was filed in the US. This is important for two reasons: 1) The US is the ‘holy grail’ for EVO as more and more states open themselves up to online casinos. In fact, EVO management thinks the US can end up being 10x larger than Europe. 2) The US has some of the strictest anti-money laundering/KYC laws, and dealing with sanctioned countries is a HUGE no-no. If one US state were to withdraw EVO’s ability to operate, the action could have ramifications for other states, and perhaps other countries.

In fact, we’ve been thinking about this risk for several weeks after Regulus Partners (an advisory firm focusing on sports and leisure sectors) posted this in their weekly newsletter: “In Live, Evolution is likely to face increasing maturity and competition in core markets, but its dominance is self-fulfilling in the short term. The big question is the extent to which growth in more 'exotic' markets, where Live is infrastructure just as much as content (i.e., not all that arms-length, even if offshore), starts to impact perceptions in the US. So far, operators and suppliers which mix US and .com exposure have had an easy ride, but this remains a regulatory / lobbying weak spot which would not require all that much hindsight or reflection should it start to cause structural problems”

Moving back to the report filed with the NJDGE, here is where we thought the report was quite dubious and where there was some merit to the claim.

The dubious parts:

“Evolution does not carry out a KYC ("Know Your Customer") process to implement its anti-money laundering policy”: The report kept claiming that Evolution does not do adequate KYC checks on its users. This is quite ridiculous. EVO does not operate any casinos. It is simply a supplier to casinos. In fact, EVO does not onboard any end-user and EVO does not actually ever touch an end-player’s money. EVO makes money by invoicing the casino (either for their share of winnings or for dedicated tables or both).

“Clear evidence shows that Evolution games are being offered in designated terror states such as Iran, Syria and Sudan.” The report showed that a user was able to (using an Iranian IP) log on to an online gambling site and play an Evolution Game. Evolution hit back strongly against this claim in their response (which we will discuss in detail below) stating that the investigators who created this report first logged in using a VPN (which masks the end users IP address) and then turned off the VPN to show that they were playing for Iran. EVO also stated that any IP address detected from a sanctioned country is blocked. The report includes several grainy screenshots that don’t necessarily prove much (as they can be manipulated very easily). Further, we find it hard to believe that EVO would risk its huge potential in the US to serve sanctioned countries. It would be like running into traffic to pick up a penny when there is a bag of gold on the sidewalk.

The Troubling Parts:

“Furthermore, live casino games produced by Evolution are being offered to end-users -those who ultimately use their product – in territories where gambling is illegal, including in Hong Kong, Singapore, France and the UAE.” While we cannot comment on HK, France or, the UAE, we have discovered this is true of Singapore, because we reside here. More importantly, it is true without having to use a VPN. While Singapore does a good job of blocking most operators, new ones spring up all the time. In fact, the report named a few operators that we noticed were not blocked by local firewalls. Any Singaporean will also tell you that we often received unsolicited texts asking us to play Live Casino (sometimes several times a day). Further, while Singaporean financial institutions will ban any payment to a gambling provider, cryptocurrencies provide a way around this. Now we are not naïve, we had assumed that the “Asia” section in EVOs revenue disclosure would have to include revenue from countries where it is illegal to gamble online. However, we always assumed it was through a VPN making it difficult to track or trace. The fact that it can be done without a VPN was a surprise to us.

“A senior Evolution Executive who reports directly to the CEO” The report quoted this senior executive often, and in fact, did seem to name him/her (although the name is redacted in the publicly available report). Some of the quotes about EVO knowing when IP addresses are manipulated through VPNs were troubling. There were several other quotes, but without context or the full transcripts some might be red-herrings or misinterpreted.

There were several more claims in the report and interested parties should read it themselves. However, we thought the four points above were the most important to talk about.

EVO’s defense:

EVO released a defense of their company and here are the key highlights (it can be read here).

EVO stated that it is the responsibility of operators to do the KYC, etc. Here, they used the example of land-based casinos where regulators do not hold slot machine providers liable for the casino’s clients.

Evolution does block users from certain countries, including sanctioned countries

The operators in the report were not EVO clients but instead clients of an aggregator (who is an EVO customer).

Now this defense raises several questions in our minds. For one, if EVO can and does block IP addresses from sanctioned countries, it implies they can detect IP addresses from countries where it is illegal to gamble online, and it does not seem like it is blocking those (or letting some through). If this assumption is correct, the question is why do they not block those addresses? It could be the ‘operator’ defense or if we were to take on a more nefarious tone, it could be about greed.

Further, while the operator used in the report came through an aggregator, the question is how responsible is EVO for the aggregators it works with? To answer this, we come back to the operator defense, we feel there is a lot of merit to this. For example, a land-based casino does zero KYC on players playing in their locations. All you must prove is you are of age, and you are free to enter. The problem here is that most laws are not updated to deal with online business. This, in essence, was and continues to be the issue about Facebook’s liability relating to the content published on their platform. Is EVO responsible for what their operators do? Or put another way, is a supplier responsible for what their client does? In most cases, the answer is solidly no, we don’t blame the supplier of McDonald’s potatoes for contributing to a global obesity problem. However, when it comes to the handling of money, the answer may be yes. To this point, we don’t think this should be a yes, but the regulator might think so.

This brings us to the question of the NJDGE, and how they might interpret this report. Some of the questions they may pose are as follows:

Is EVO responsible for its operators’ (client’s) actions? As stated, this would and should also apply to suppliers of land-based casinos – but as we know, the online world is treated differently.

If EVO can block IPs from sanctioned countries, shouldn’t they also block them for countries where it is illegal to gamble online?

On the above – should the NJDGE care about the countries where it is illegal to gamble online (if they are not sanctioned countries)? As far as we can see EVO is not breaking any laws by supplying to operators who may be operating illegally (although we are far from legal experts). We think the question is if EVO is aware, will the regulator require them to stop dealing with such operators. Do not that this is a grey area and from what we can tell the NJDGE (and other regulators) only require supplier and operators to stop traffic from countries that clearly and actively try to prohibit online gambling (like Australia).

The range of outcomes here are quite vast. For one, the NJDGE could dismiss the report, and if so, pave the way for many more states allowing EVO to operate. Considering there is no serious competition to EVO in the Americas, this would be a huge tailwind. Second, the NJDGE or the like could issue a fine and ask EVO to tighten up, which would be bad in the short-term but probably good in the long-term (but in the short-term revenues would take a big hit). This would also impact almost every other ‘competitor’ in the space who would probably have similar problems. Or third, the NJDGE could remove EVO’s license which would make it very hard to get any other license in the states and perhaps make European regulators question their agreements with EVO as well.

Assuming there are three potential outcomes, and two of those outcomes would indeed affect EVO’s revenues at least in the short-term, it doesn’t make the odds look particularly great. Obviously, this all depends on the weights you assign to each of those outcomes, and without knowing the mindset of the NJDGE, this could be tough to do. That said, we would be quite surprised if the regulators in the US were so naïve or ignorant that anything in the report came as a shock to them (except for the sanctioned countries bit, but as stated this appears to be highly manipulated).

There is a fourth outcome which we think might end up being the most likely one (famous last words!). That is that the NJDGE dismisses the report but investor pressure and general ESG trends forces EVO to become even tighter on where and with whom they do business. This would put a serious dampener on growth in Asia and would take at least a few quarters (perhaps years) before US (regulated) revenues make up for the shortfall. We will say though considering the ~43% drop in share price from it’s all-time-high, this outcome is most likely priced in.

In the end, unlike some bulls, we unfortunately do see some merit to the report despite its shady origin, obvious bias and malintent. We did pose our questions above when we spoke to EVOs Investor Relations team and while we will keep details of that conversation private, we will say that we found their responses honest and the conversation fruitful. Investors will now have to decide for themselves if the uncertainty is worth sticking with a company which otherwise has a phenomenal business. Judging by the rapid decline in price, many investors seem to have already made that decision.

Note:

We wrote the above to be honest with our process and to be transparent whether our investments move up or down. We feel this both forces us to learn and generates trust with our investor base. Lastly, we want to show that investing isn’t easy and heavy drawdowns are part of the game. Thank you for reading our blog – happy investing!